The UK Government published its white paper A New Vision for Water on 20 January 2026, following the Independent Water Commission’s review of the water sector in England and Wales. The review, chaired by Sir John Cunliffe, set out a series of recommendations to modernise regulation, improve long-term planning, and strengthen public confidence in water services.

While headlines have focused on proposals for a new single water regulator, improved planning frameworks and greater data transparency, the question for many is: what does this mean for the plumbing industry?

Here are six key takeaways for the plumbing sector, with a particular emphasis on water efficiency and public health.

The government has confirmed that the Mandatory Water Efficiency Label (MWELS) will be implemented in 2026.

The scheme will require retailers to display a clear A–F water efficiency rating for water-using products such as taps, showers, toilets, and dishwashers at the point of sale. It will help consumers make informed choices. Eventually, MWELS will be incorporated into building regulations to ensure new homes are designed with water efficiency at their core. Manufacturers may also need to develop new products with lower flow rates than those currently supplied to the UK and European markets.

MWELS aims to reduce household consumption—saving an estimated 1,200 million litres of water per day, equivalent to the daily needs of Birmingham, Manchester, Glasgow, Belfast and Cardiff combined. Over ten years, it could save consumers £51 million on water bills and £71 million on energy bills. Not surprisingly, support for the scheme is widespread across industry and consumer groups.

Smart metering is set to play an increasingly important role in managing water demand. Smart meters not only help identify leaks but give households and businesses clear insights into how much water they use something most people significantly underestimate (average use is around 150 litres per person per day).

The water industry has already committed to installing 10 million new smart meters for households and 800,000 for non-household customers over the next five years. The white paper largely reinforces these existing plans while emphasising improved customer access to data.

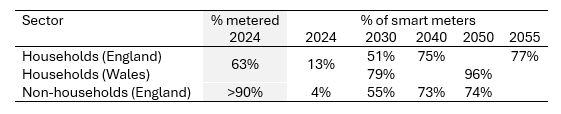

A summary of current and projected meter coverage1 shows the scale of ambition:

Smart metering will continue to be a major touchpoint between water companies and the plumbing industry as households seek leak detection, repairs, and advice on water-saving products.

The white paper confirms that rolling block tariffs for businesses will be phased out by April 2026. These tariffs can perversely reward higher water use by reducing unit costs at higher consumption levels.

Government, Ofwat and eventually the new regulator will work together to develop improved incentives for both businesses and households. This could accelerate innovation in water-efficient products and services, giving manufacturers and installers new opportunities.

The government is already updating building regulations to support greater adoption of water reuse. The white paper further announces a new non-household customer journey group, focused on understanding how businesses, commercial buildings and the public sector can be supported to install reuse systems.

However, barriers to water reuse such as skills, ownership, financing and regulatory barriers remain largely unaddressed in the paper. With the UK facing a projected 5 billion litre per day shortfall by 2050, water reuse will be essential. Safe installation, operation and maintenance are critical, and the need for competent, well-trained professionals cannot be overstated.

The White Paper’s welcome push toward water reuse, efficiency, and higher installation standards highlights the risk of a growing skills gap.

We welcome the government’s recognition of the need for further work in this area.

This will see the water functions of Ofwat, the EA, the DWI and the come together to provide unified oversight of the water sector. The DWI was recognised as being an effective regulator – so it will be important that the new water regulator builds on these strengths. There are commitments to provide additional powers to the new regulator:

To investigate and enforce the security and emergency measures direction

To act more quickly against companies who are not complying with drinking water regulations, including the ability to impose financial penalties rather than take them to court.

To take enforcement action against any third party operating a water treatment or supply asset.

To make legislation on sufficiency

So the whole water company supply chain, may find themselves under greater scrutiny to protect public health.

The white paper proposes that the new regulator will convene a Drinking Water Quality Advisory Group, responsible for recommending updates to drinking water standards. This builds on the Drinking Water Inspectorate’s existing Water Advisory Group, established in 2024 to provide scientific and technical advice, an important function post-Brexit, as the UK now independently updates water quality regulations.

A key evolution under the new structure is the commitment to incorporate impact assessments, considering value for money alongside public health and consumer confidence.

The group’s recommendations may have future implications for water fittings standards. For example, in 2024 the advisory group recommended a cross-government strategy to reduce lead exposure, including tightening the lead standard in drinking water from 10 µg/L to 5 µg/L. The sector awaits the response from the governments of England and Wales.

Products used in public drinking water infrastructure must be approved under Regulation 31 of the Water Supply (Water Quality) Regulations, demonstrating they are suitable for use within the water distribution network. This affects materials and products owned by water companies and requires rigorous testing.

Plumbing products used in domestic or commercial buildings fall under Regulation 4 of the Water Supply (Water Fittings) Regulations and Byelaws. WRAS has made significant progress in expanding testing capacity, six laboratories are now recognised for materials testing, up from three five years ago. Encouragingly, five of these labs are also designated by the DWI for BS 6920 testing for small surface area products.

WRAS hopes more recognised laboratories will expand into Regulation 31 testing, especially for leachate studies, providing manufacturers with greater support in demonstrating product safety.

The original timetable anticipated publication of the white paper in Autumn 2025, alongside a consultation and an integrated transition plan. These transition plans, now expected later in 2026, will include detailed roadmaps for implementation.

The government has committed to maintaining a transparent and collaborative approach as reforms progress, drawing on expertise from across the water sector. Celebrating progress to maintain momentum will also be vital—transformational change of this scale will take time.

References

1 Independent Water Commission, Final Report, 21 July 2025

We use cookies to give you the best possible experience with WRAS. Some are essential to provide website functions and ensure the website is secure. We also use cookies to help us understand how people use the site and to make improvements. Click "Accept All" to enable recommended settings or click "Manage cookies" to adjust your settings. For more details, see our Cookie Policy.